India’s Infrastructure Supercycle 2026: Why Land Corridors Are Becoming the Smartest Long-Horizon Allocation

Land investment India 2026 is no longer driven by speculation, but by infrastructure that compresses time, strengthens logistics, and reshapes economic geography for long-term value.

Land investment India 2026 is no longer driven by speculation, but by infrastructure that compresses time, strengthens logistics, and reshapes economic geography for long-term value.India’s Infrastructure Supercycle 2026: Why Land Corridors Are Becoming the Smartest Long-Horizon Allocation

If you’re studying land investment in India 2026, you’re not really studying “real estate.” You’re studying national intent—how a country redraws its economic map using roads, freight rail, ports, and industrial nodes.

Table of Contents

- India’s Infrastructure Supercycle 2026: Why Land Corridors Are Becoming the Smartest Long-Horizon Allocation

- What “Infrastructure Supercycle” Actually Means (and why 2026 is a tipping point)

- Why Corridors Create Land Wealth (not instantly—then suddenly)

- The Policy Backbone: What makes this cycle different for land investors

- The Corridor Effect: a 4-phase model investors can actually use

- The 7 Corridors That Matter Most for Land Investment India 2026

- 1) Delhi–Mumbai Industrial Corridor (DMIC): the industrial spine on freight logic

- 2) Western Dedicated Freight Corridor (WDFC): freight efficiency creates industrial gravity

- 3) Eastern Dedicated Freight Corridor (EDFC): patient capital territory

- 4) Delhi–Mumbai Expressway: interchange economics, not roadside optimism

- 5) Bharatmala Economic Corridors: national logistics repricing at scale

- 6) Industrial corridors beyond DMIC: the manufacturing layer broadens

- 7) Sagarmala / port-led development: coastal logistics meets industrialization

- Where land value actually concentrates: the “node-first” map

- A) Expressway interchanges and connectors

- B) Freight terminals and logistics parks (DFCs)

- C) Industrial nodes (NICDC / corridor nodes)

- What type of land wins in corridor economies (and what often disappoints)

- 1) Land with clear title chains (boring is powerful)

- 2) Land with realistic land-use pathways

- 3) Land with access (not just proximity)

- 4) Plotted land near expanding towns

- 5) Low-density lifestyle land (selective, not universal)

- Why HNIs, NRIs, and policymakers are paying attention to land investment in India 2026

- HNIs and family offices: wealth preservation + compounding

- NRIs: clarity, governance, and long-term optionality

- Policymakers and politically exposed investors: alignment with development direction

- How to build a corridor-led land thesis (without chasing hype)

- Step 1: Start with the corridor category

- Step 2: Identify the nodes, not the line

- Step 3: Confirm execution evidence

- Step 4: Apply land filters

- Step 5: Match holding period to corridor phase

- The quiet truth: “corridor wealth” is built in the boring middle

- FAQs

- Land, when aligned with a nation’s direction, becomes more than an asset

In every large economy, land wealth is created when three forces align: policy, connectivity, and capital. India is now in that alignment window. The difference in this cycle is that infrastructure is not being built as isolated projects. It is being built as corridors—integrated networks that compress time, cut logistics costs, and shift where people live, where industry clusters, and where demand compounds.

That’s the core reason land investment in India 2026 has become a serious thesis for HNIs, NRIs, policymakers, and long-term investors. This is not about chasing a “hot micro-market.” It’s about understanding where India is deliberately moving its next decade of productivity—and positioning land exposure around that movement.

What “Infrastructure Supercycle” Actually Means (and why 2026 is a tipping point)

An infrastructure supercycle is not a one-year spike in capex. It’s a multi-year, multi-ministry, execution-backed transformation that changes cost structures and growth patterns across the economy. In India’s case, several national frameworks are converging:

- The National Infrastructure Pipeline (NIP) projected infrastructure investment of around ₹111 lakh crore during FY20–25, laid out by the Government of India.

- PM Gati Shakti National Master Plan (launched in Oct 2021; approved for implementation by the Cabinet Committee on Economic Affairs), built to deliver multimodal connectivity and integrated planning for economic zones.

- Bharatmala Pariyojana, approved in 2017 to improve connectivity and reduce logistics cost, where official updates cite 26,425 km awarded and 18,714 km constructed (as on 31.10.2024).

- Dedicated Freight Corridors (DFCs): The government states the EDFC is Ludhiana–Sonnagar (1337 km) and the WDFC is JNPT–Dadri (1506 km).

- Sagarmala, a flagship maritime programme aimed at port-led development, leveraging India’s coastline and waterways.

Why does 2026 matter in the context of Land Investment in India 2026?

Because this is the period when multiple corridors move from “map stage” and partial execution into a more visible, functional network—where travel times compress, freight routes stabilize, and industrial nodes begin to behave like magnets. In land markets, those are the moments that separate headline hype from structural repricing.

So if you’re evaluating land investment in India 2026, you’re evaluating whether India’s corridor model is entering the “usable infrastructure” phase. And in many parts of the country, it already is.

Why Corridors Create Land Wealth (not instantly—then suddenly)

Land markets don’t move like stock markets. Land is slower, more regulated, and heavily dependent on access, services, and permissions. But that’s exactly why land investment India 2026 is gaining attention from patient capital: the returns, when they arrive, are often durable.

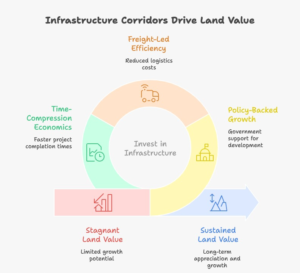

Infrastructure corridors create land value through four mechanisms:

1) Time compression becomes value creation

When an expressway reduces a six-hour journey to three hours, it doesn’t just save time. It expands commuting and weekend-living catchments, changes how goods move, and alters what “near a city” means. For Land Investment in India 2026, time compression is the invisible engine behind demand.

2) Lower logistics costs rewire industrial geography

When freight becomes cheaper and faster, production can shift to new clusters. That shift drives employment. Employment drives housing and services. Housing and services drive land demand. That chain is why the serious land investment India 2026 analysis starts with freight and roads—not with property listings.

3) Nodes outperform lines

The most consistent land repricing happens at nodes: interchanges, terminals, junctions, and industrial parks—rather than along a continuous highway line. A corridor is the spine; nodes are the organs. In land investment India 2026, node logic matters more than “X km from the road.”

4) Integrated planning reduces execution risk

Historically, India’s biggest risk was not policy ambition—it was coordination. PM Gati Shakti exists specifically to reduce siloed planning and enable integrated project prioritization.

For land investment in India 2026, this matters because execution risk is valuation risk.

The Policy Backbone: What makes this cycle different for land investors

When people say “infrastructure is bullish,” that’s usually vague. For land investment India 2026, you need specifics—frameworks that affect where land actually gets attention.

PM Gati Shakti: the “integration layer.”

PM Gati Shakti is explicitly built for multimodal connectivity to economic zones and is positioned as a transformative approach for growth and sustainable development.

This is a quiet but significant shift: rather than building a road and hoping industry follows, the government is planning roads + rail + ports + logistics + industrial zones as one system.

NIP: the scale layer

The NIP framework and related government updates frame the investment as around ₹111 lakh crore and provide a project pipeline approach.

For land investment India 2026, this matters because it indicates continuity: an ecosystem of projects rather than isolated announcements.

Bharatmala: the “economic corridor” layer

Official Bharatmala updates give measurable progress—awarded and constructed kilometres—which is the kind of evidence long-horizon investors prefer.

And more recently, PIB also referenced 19,826 km constructed (as on 28.02.2025) against 26,425 km awarded.

For the land investment India 2026, measurable progress is more useful than narrative.

DFCs: the freight layer

The Ministry of Railways’ official corridor lengths (EDFC 1337 km, WDFC 1506 km) matter because freight rail changes where warehouses, industrial parks, and distribution hubs naturally form.

If you’re doing land investment in India 2026, ignoring freight is like ignoring gravity.

Sagarmala: the port-led layer

Sagarmala is described as a port-led development programme that harnesses India’s coastline and waterways.

Port ecosystems create predictable land demand around connectivity, industrialization, and logistics—especially where road and rail spurs converge.

The Corridor Effect: a 4-phase model investors can actually use

Most people look at corridor announcements and assume immediate appreciation. That’s not how land investment India 2026 should be approached.

A more realistic model:

Phase 1 — Announcement (high noise, low certainty)

Prices can spike, but liquidity is thin, and speculation is highest. This is where uninformed land investment in India 2026 becomes risky.

Phase 2 — Construction (evidence phase)

Tendering, land acquisition progress, visible work, and package completion reduce uncertainty.

Phase 3 — Commissioning & usage (demand phase)

When freight starts moving, travel times drop, and businesses reroute logistics—this is when real demand arrives.

Phase 4 — Clustering (compounding phase)

Industrial parks mature, labour markets stabilize, services grow. This is where land investment in India 2026 begins to compound, not just “rise.”

The 7 Corridors That Matter Most for Land Investment India 2026

Below are seven corridor categories where policy backing and measurable infrastructure progress make them relevant to Land Investment in India 2026. This isn’t a “buy everywhere” list. It’s a framework for understanding where land demand can become structurally reinforced.

1) Delhi–Mumbai Industrial Corridor (DMIC): the industrial spine on freight logic

NICDC explicitly describes DMIC as the first industrial corridor on the backbone of the Western Dedicated Freight Corridor, covering an overall length of 1504 km, with terminals at Dadri and JNPT.

Why it matters for land investment in India 2026:

- DMIC is not “a highway story.” It’s a manufacturing + logistics + urbanization story.

- Land demand tends to concentrate around designated nodes where industrial activity, utilities, and approvals converge.

What to look for (not advice, a research lens):

- Land with a clear title and realistic land-use pathways

- Proximity to logistics hubs/terminals rather than just “near the corridor.”

- Evidence of industrial allotment activity, utilities, and workforce housing needs

2) Western Dedicated Freight Corridor (WDFC): freight efficiency creates industrial gravity

The government describes WDFC as JNPT–Dadri (1506 km).

Why it matters for land investment in India 2026:

Freight rail corridors don’t just move goods—they reshape where warehouses, distribution centres, and supplier ecosystems form. For land investment in India 2026, the strongest demand pockets are often near:

- container depots

- logistics parks

- feeder road junctions

- industrial clusters tied to freight movement

3) Eastern Dedicated Freight Corridor (EDFC): patient capital territory

The government describes EDFC as Ludhiana–Sonnagar (1337 km).

Why it matters for land investment in India 2026:

In many eastern belts, land pricing is slower—but often more stable when driven by industrial and logistics fundamentals. This corridor matters where:

- manufacturing decentralises

- agro-processing integrates with logistics

- Feeder highways reduce last-mile friction

For land investment India 2026, “slow compounding” is a feature, not a flaw—especially for NRIs and legacy families.

4) Delhi–Mumbai Expressway: interchange economics, not roadside optimism

PIB states the Delhi–Mumbai Expressway (including spurs) has 1386 km, with 82% physical progress as of June 2024 and a revised scheduled completion date of October 2025.

Why it matters for land investment in India 2026:

Access-controlled expressways create value at interchanges and connectors more than continuous roadside strips. Smart land investment India 2026 here is about mapping:

- where traffic enters/exits

- where feeder roads meet

- where towns become “new-distance suburbs.”

5) Bharatmala Economic Corridors: national logistics repricing at scale

Official updates: Bharatmala covers 34,800 km, with 26,425 km awarded and 18,714 km constructed as of 31.10.2024.

Why it matters for land investment in India 2026:

This is the scale layer. Bharatmala isn’t about one route—it is a network. For land investment India 2026, it expands investable geography beyond metro adjacency into:

- Tier-2 corridors

- feeder-route towns

- logistics-driven peri-urban markets

6) Industrial corridors beyond DMIC: the manufacturing layer broadens

PIB notes corridors like Amritsar–Kolkata, Chennai–Bengaluru, East Coast Economic Corridor, and Bengaluru–Mumbai as part of India’s industrial landscape, highlighting their role in strengthening manufacturing ecosystems.

Why it matters for land investment in India 2026:

Industrial corridors drive a very specific land demand stack:

- industrial parks and vendor ecosystems

- rental housing for the workforce

- plotted housing expansions near growing towns

- services and retail

For land investment in India 2026, this is less about luxury and more about sustained absorption.

7) Sagarmala / port-led development: coastal logistics meets industrialization

The Ministry of Ports, Shipping and Waterways describes Sagarmala as promoting port-led development, leveraging India’s coastline and waterways.

Why it matters for land investment in India 2026:

Ports act like permanent demand engines when connectivity improves. Land demand strengthens where ports connect to:

- freight rail spurs

- highways

- industrial clusters

- logistics parks

For land investment India 2026, port-led themes are especially relevant when you’re looking for “infrastructure certainty” rather than speculative glamour.

Where land value actually concentrates: the “node-first” map

A practical mistake in land investment in India 2026 is treating corridors like a single continuous opportunity. Corridors behave like networks. Networks concentrate value at nodes.

Here’s how to think in node bands:

A) Expressway interchanges and connectors

- 0–2 km: highest speculation, highest noise, highest regulatory friction

- 2–8 km: often the best balance of access and developability

- 8–25 km: compounding zone—town expansion, plotted communities, services

B) Freight terminals and logistics parks (DFCs)

A terminal changes land demand because it changes route selection. The strongest zones for land investment in India 2026 are typically:

- 3–12 km from terminals

- along the feeder junctions that reduce last-mile costs

C) Industrial nodes (NICDC / corridor nodes)

Industrial nodes outperform because they bring utilities, planning priority, and employment. If you’re evaluating land investment in India 2026, industrial node maps are often more important than consumer real estate narratives.

What type of land wins in corridor economies (and what often disappoints)

Not all land appreciates equally, even in the best infrastructure story. For land investment India 2026, the land that “wins” tends to share three attributes: clear title, use clarity, and access.

1) Land with clear title chains (boring is powerful)

Corridor-led land demand attracts serious capital only when title risk is low. This is especially true for NRIs and institutional investors evaluating land investment in India 2026.

2) Land with realistic land-use pathways

Agricultural land can outperform, but only where conversion and compliance are realistic. Land-use clarity becomes a multiplier in land investment in India 2026.

3) Land with access (not just proximity)

A parcel “near the corridor” but without legal and physical access can remain illiquid. In Land Investment in India 2026, access is often the difference between a paper valuation and a tradable asset.

4) Plotted land near expanding towns

Corridor nodes often expand towns faster than housing supply can adapt. Planned development can do well where growth is real and civic infrastructure follows.

5) Low-density lifestyle land (selective, not universal)

For HNIs, a corridor can enable weekend-living and second-home demand by compressing travel time. But it only works where zoning, approvals, and local governance allow stable development. For Land Investment India 2026, lifestyle overlays should be an additional layer—not the entire thesis.

Why HNIs, NRIs, and policymakers are paying attention to land investment in India 2026

Different investor profiles arrive at land investment in India 2026 for different reasons:

HNIs and family offices: wealth preservation + compounding

Land aligned with long-term infrastructure can behave like a macro-hedge: inflation resilience, currency resilience (for NRIs), and intergenerational holding value.

NRIs: clarity, governance, and long-term optionality

NRIs often prefer assets that can be held without constant operational oversight. Corridors with government-backed frameworks provide a logic that is easier to monitor and evaluate remotely—especially when anchored in public sources like PM Gati Shakti, PIB project updates, and DFC corridors.

Policymakers and politically exposed investors: alignment with development direction

For investors close to policy and governance, land aligned to planned growth can be viewed as a structured exposure to national development priorities—provided compliance and ethics remain strict and transparent.

In all cases, land investment India 2026 tends to attract those who prefer predictable compounding over headline-driven speculation.

How to build a corridor-led land thesis (without chasing hype)

A credible land investment India 2026 thesis is built like an infrastructure project: layer by layer.

Step 1: Start with the corridor category

- Freight corridor (DFC)

- Expressway network (Bharatmala / specific expressway)

- Industrial corridor (NICDC / DPIIT ecosystem)

- Port-led connectivity (Sagarmala)

Step 2: Identify the nodes, not the line

Find terminals, interchanges, logistics hubs, industrial nodes, and feeder junctions.

Step 3: Confirm execution evidence

Use official sources—PIB releases for construction progress, corridor lengths, and programme status.

Step 4: Apply land filters

Title, land use, access, environmental constraints, local governance, and market liquidity.

Step 5: Match holding period to corridor phase

- If it’s Phase 1, you need a higher risk appetite

- If it’s Phase 2, you need research discipline

- If it’s Phase 3–4, you need patience and prudence

This is how land investment India 2026 becomes an allocation strategy rather than a bet.

The quiet truth: “corridor wealth” is built in the boring middle

The most overlooked truth in land investment India 2026 is that the real money is rarely made at the peak of excitement. It’s made when:

- The corridor is no longer a concept

- traffic patterns and freight flows become visible

- towns begin to expand

- Services begin to follow employment

- Demand turns from speculative to functional

That “boring middle” is where land becomes liquid, where valuation becomes defensible, and where long-horizon investors are most comfortable.

This is why government updates that quantify progress—like Bharatmala’s km awarded/constructed and the expressway package completion data—matter so much for land investment India 2026.

FAQs

1- Is land investment in India 2026 mainly about highways?

No. While highways matter, land investment in India 2026 is equally driven by freight rail, industrial corridors, and port-led connectivity. Dedicated Freight Corridors, for instance, separate freight from passenger rail and improve logistics efficiency—creating predictable demand near terminals and logistics nodes.

2- What makes PM Gati Shakti relevant to land investment in India 2026?

PM Gati Shakti is designed to enable integrated, multimodal planning for economic zones rather than siloed projects. That improves execution coherence, which reduces risk for long-horizon investors evaluating land investment in India 2026.

3- How does Bharatmala support the land investment India 2026 thesis?

Bharatmala is a national highways programme with measurable progress updates published publicly (awarded and constructed km). Such execution data helps separate hype from reality in land investment India 2026 analysis.

4- What is the most common mistake people make in land investment in India 2026?

Buying “near a corridor” without understanding:

- access design

- node economics

- land use permissions

- execution evidence

That’s how land investment India 2026 turns into illiquid holdings.

Are port-led themes relevant to land investment in India 2026?

Yes—Sagarmala explicitly focuses on port-led development and connectivity, which can create durable land demand around logistics and industrial clusters.

Land, when aligned with a nation’s direction, becomes more than an asset

The most persuasive argument for land investment in India 2026 is not a promise of fast appreciation. It’s the logic of alignment.

India’s corridor-led strategy—through PM Gati Shakti’s integrated planning, Bharatmala’s highway networks, DFC freight spines, industrial corridor development, and port-led programmes—signals a decade where connectivity will be designed, not accidental.

For HNIs, NRIs, and long-horizon investors, land investment India 2026 is ultimately a question of discipline: choosing parcels where access, legality, and execution evidence converge—and holding them with patience while infrastructure converts geography into economics.

And for those who approach land as stewardship rather than speculation, the opportunity isn’t merely to “own land.” It’s to hold a position in the country’s next map of productivity—quietly, responsibly, and for the long term. In that spirit, Nine Divine remains rooted in a land-first philosophy: luxury as space and design integrity, and value as something that compounds over generations rather than quarters.

Latest Posts

You Might Also Like

Nine Divine Group specializes in sustainable living, eco-friendly development, and heritage property restoration for modern lifestyles.

TOP NEWS

CONTACT INFO

Phone:

+91 72 9100 8100

Email :

info@ninedivinegroup.com

Address :

FF-12A, Sethi mart, near Mahagun Meadows,

Sector 150, Noida, Uttar Pradesh 201304

© 2025 Nine Divine Group. All Right Reserved.

No Comments