Why Coastal Land Markets Operate on a Different Economic Clock

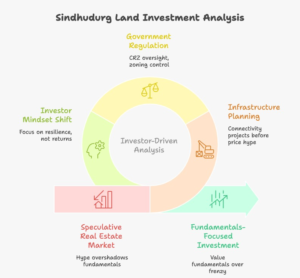

Sindhudurg land investment 2025 reflects a shift toward research-driven decisions, where infrastructure, regulation, and resilience matter more than rapid speculation.

Sindhudurg land investment 2025 reflects a shift toward research-driven decisions, where infrastructure, regulation, and resilience matter more than rapid speculation.Why Coastal Land Markets Operate on a Different Economic Clock

Before evaluating Sindhudurg specifically, it’s essential to understand why coastal land behaves differently from most other real estate assets in India.

Table of Contents

- Why Coastal Land Markets Operate on a Different Economic Clock

- Infrastructure as the Primary Catalyst: What Is Actually Changing?

- The Nagpur–Goa Shaktipeeth Expressway

- Understanding the Infrastructure Timeline: Why Timing Matters More Than Completion

- Why Investors Are Looking Beyond Goa

- Micro-Markets Within Sindhudurg: Why Location Precision Matters

- Sustainability and Coastal Resilience: A Value, Not a Trend

- Legal and Regulatory Reality: What Must Be Verified

- Expected Returns: Separating Reality From Assumptions

- Who Should Consider Sindhudurg Land Investment 2025 — And Who Should Not

- FAQs

- Why Sindhudurg Is Being Studied — Not Sold

- A Market That Rewards Research, Not Impulse

- Infrastructure Before Hype — A Rare Sequence

- Regulatory Friction as a Filter, Not a Barrier

Urban real estate is volume-driven. Coastal real estate is constraint-driven.

Cities expand through vertical development, redevelopment, and densification. Coastal regions, however, are governed by a mix of environmental regulations, zoning controls, and natural limitations. India’s Coastal Regulation Zone (CRZ) framework restricts indiscriminate construction to protect sensitive ecosystems.

This distinction has profound implications for Sindhudurg land investment 2025.

First, supply in coastal regions is structurally limited. Even when demand rises, new land cannot be created easily. Second, appreciation tends to be slower initially but more durable over time. Coastal land rarely experiences sudden speculative spikes unless driven by misinformation. Instead, it responds steadily to infrastructure, accessibility, and lifestyle adoption.

Historically, coastal regions across India — from parts of Maharashtra to Kerala and Karnataka — have shown that land value increases in phases rather than surges. Early buyers often benefit not because prices explode, but because demand expands into a market where supply remains controlled.

This is why investors researching Sindhudurg land investment 2025 are focusing less on short-term gains and more on structural alignment.

Infrastructure as the Primary Catalyst: What Is Actually Changing?

Every major land appreciation story in India has one common thread: infrastructure. Roads, expressways, airports, and rail connectivity alter how people move — and how markets perceive distance.

The Nagpur–Goa Shaktipeeth Expressway

One of the most important developments influencing Sindhudurg land investment 2025 is the Nagpur–Goa Shaktipeeth Expressway. Approved by the Maharashtra government, this 800+ km expressway is designed to connect eastern Maharashtra directly to the Konkan coast.

Key facts:

- Estimated investment exceeds ₹20,000 crore

- Connects 12 districts across Maharashtra

- Reduces travel time between Nagpur and Goa/Sindhudurg dramatically

- Land acquisition has already been approved and initiated

The infrastructure of this scale does not simply make travel faster. It reshapes regional economics by:

- Expanding feasible commuting zones

- Attracting capital into previously remote districts

- Reducing logistical and psychological distance

For Sindhudurg land investment 2025, this expressway represents a shift from isolation to accessibility — a transition that historically precedes land value appreciation.

Understanding the Infrastructure Timeline: Why Timing Matters More Than Completion

A common mistake investors make is waiting for infrastructure projects to be fully completed before acting. By then, much of the upside has already been priced in.

Infrastructure impacts land markets in three stages:

- Announcement and Approval Phase

Smart capital enters quietly, often facing skepticism. - Execution Phase

Land values begin adjusting as visibility improves. - Operational Phase

End-user demand increases, pushing prices higher but reducing entry advantage.

Most indicators suggest Sindhudurg is currently moving from Stage 1 into Stage 2. This is why Sindhudurg land investment 2025 is being discussed now — not because the expressway is complete, but because its trajectory is clear.

This pattern has repeated across other infrastructure corridors in India, including the Samruddhi Mahamarg and the Yamuna Expressway, where land values adjusted significantly during construction rather than after completion.

Why Investors Are Looking Beyond Goa

For decades, Goa dominated India’s coastal real estate narrative. But mature markets behave differently from emerging ones.

Goa today faces:

- High land entry costs

- Limited availability

- Dense development in many pockets

- Regulatory complexity for new buyers

This does not mean Goa is declining. It means it has reached a stage where early-cycle returns are no longer available.

Investors researching Sindhudurg land investment 2025 are not rejecting Goa; they are applying a familiar real estate principle: value migrates outward from saturated cores.

Sindhudurg benefits from:

- Geographic proximity to Goa

- Similar coastal characteristics

- Lower population density

- Less development pressure

- Emerging connectivity rather than exhausted infrastructure

Market research firms consistently note that regions adjacent to mature hubs often capture the next phase of growth.

Micro-Markets Within Sindhudurg: Why Location Precision Matters

Sindhudurg is not a single market. Treating it as one is one of the biggest mistakes investors make.

Micro-markets within Sindhudurg differ based on:

- Proximity to NH-66

- Access road quality

- Terrain and elevation

- Distance from CRZ-restricted zones

- Availability of civic infrastructure

Areas such as Sawantwadi, Vengurla, and Tarkarli each have distinct characteristics. Government portals like Maharashtra’s land records system and district planning websites clearly illustrate how zoning and classification vary by location.

For Sindhudurg land investment 2025, micro-location selection often matters more than headline pricing. Cheaper land without access or clarity can underperform more expensive but well-connected parcels over time.

Sustainability and Coastal Resilience: A Value, Not a Trend

Search behavior shows increasing interest in sustainability-related terms alongside the Sindhudurg land investment 2025. This reflects a broader shift in how investors evaluate land.

Coastal regions face:

- Flood risk

- Soil erosion

- Heat stress

- Regulatory tightening over time

Sustainable land use is no longer just an environmental concern; it is an economic one. International studies from UNEP and the Indian Green Building Councils show that properties aligned with climate-responsive planning retain value better during regulatory transitions.

In coastal districts like Sindhudurg, sustainability enhances:

- Long-term usability

- Regulatory resilience

- Buyer confidence during resale

This is why eco-sensitive planning is becoming central to Sindhudurg land investment 2025 discussions.

Legal and Regulatory Reality: What Must Be Verified

Fear around legality is one of the biggest barriers for new buyers researching Sindhudurg land investment 2025. These fears are justified — but manageable.

Key aspects to verify:

- Land classification (agricultural vs non-agricultural)

- Coastal Regulation Zone mapping

- Title history and ownership clarity

- Access road width and public right of way

Government platforms such as the Maharashtra land records portal and revenue department provide access to this data.

Buyers who perform due diligence reduce not just legal risk, but also future liquidity risk.

Expected Returns: Separating Reality From Assumptions

Land investment requires patience. Anyone searching for guaranteed short-term returns is likely to be disappointed.

Historical data from infrastructure-led corridors across India shows:

- Appreciation typically unfolds over 5–10 years

- Liquidity improves post-connectivity

- Returns depend heavily on access and zoning

Reports by JLL and Knight Frank consistently highlight that land aligned with infrastructure planning outperforms speculative parcels in the long run.

For Sindhudurg land investment 2025, the opportunity lies in alignment — not urgency.

Who Should Consider Sindhudurg Land Investment 2025 — And Who Should Not

This opportunity is not universal.

Sindhudurg land investment 2025 may suit:

- Long-term investors

- Lifestyle-driven buyers

- NRIs seeking coastal exposure

- Buyers are comfortable with holding periods

It may not suit:

- Short-term traders

- Buyers seeking immediate rental income

- Those unwilling to engage with regulatory processes

Real estate rewards alignment, not impatience.

FAQs

1. Is Sindhudurg a good place for land investment in 2025?

Yes, Sindhudurg is increasingly considered a strong long-term land investment destination in 2025 due to a combination of infrastructure upgrades, limited coastal land supply, and growing lifestyle demand. The approval and execution of the Nagpur–Goa Shaktipeeth Expressway is expected to significantly improve accessibility to the region, which historically precedes land value appreciation. Unlike saturated coastal markets, Sindhudurg is still in an early growth phase, making Sindhudurg land investment 2025 attractive for investors with a medium-to-long-term horizon.

2. How will the Nagpur–Goa Expressway impact Sindhudurg land prices?

Large infrastructure corridors like the Nagpur–Goa Expressway typically impact land prices in stages. Even before completion, improved connectivity visibility attracts early investors and developers, leading to gradual appreciation. For Sindhudurg land investment 2025, the expressway reduces travel time from central and eastern Maharashtra, improves logistics, and increases tourism and residential feasibility. Similar expressway-led corridors in India have shown land appreciation during the execution phase rather than after completion.

3. Is Sindhudurg land safer to invest in compared to Goa?

Sindhudurg is often compared with Goa because of its coastal location, but the two markets are at very different stages. Goa is a mature market with high entry prices, limited land availability, and strict regulatory complexity for new buyers. Sindhudurg, by contrast, offers lower density, comparatively affordable entry points, and emerging connectivity. For investors researching Sindhudurg land investment 2025, the region is seen as a lower-congestion alternative with more room for structured, sustainable growth.

4. What legal checks are essential before buying land in Sindhudurg?

Before committing to any Sindhudurg land investment 2025, buyers must verify land classification (agricultural or non-agricultural), title history, access rights, and Coastal Regulation Zone (CRZ) applicability. Maharashtra’s official land records portal allows buyers to check ownership and survey details, while CRZ maps determine development restrictions. Proper due diligence reduces legal risk and improves future resale potential.

5. Does the Coastal Regulation Zone (CRZ) affect land investment in Sindhudurg?

Yes, CRZ regulations play a significant role in coastal districts like Sindhudurg. These rules restrict construction near the shoreline to protect sensitive ecosystems. However, CRZ does not mean land cannot be invested in; it means land use must align with regulations. Investors researching Sindhudurg land investment 2025 often prefer plots outside highly restrictive CRZ zones or those suitable for low-impact, eco-sensitive development.

6. What kind of returns can be expected from Sindhudurg land investment in 2025?

Land investment returns are typically long-term and depend on location, access, and regulatory clarity. For Sindhudurg land investment 2025, appreciation is expected to be gradual rather than speculative, often unfolding over 5–10 years. Infrastructure-aligned land historically outperforms isolated parcels, especially once connectivity improves and lifestyle demand increases. Investors should view this as a capital appreciation asset rather than a short-term income play.

7. Which areas within Sindhudurg are better for land investment?

Not all locations within Sindhudurg perform equally. Micro-markets closer to NH-66, established towns, or planned connectivity nodes generally show stronger long-term potential. Terrain, access road width, and civic infrastructure significantly affect usability and value. When evaluating Sindhudurg land investment 2025, focusing on micro-location quality is often more important than choosing the lowest price.

8. Is sustainable or eco-friendly land development important in Sindhudurg?

Sustainability is becoming a critical factor in coastal real estate. Climate resilience, water management, and low-impact development directly influence long-term usability and resale value. For Sindhudurg land investment 2025, eco-sensitive planning is not just an environmental choice but a risk-management strategy, especially as regulations tighten and buyers become more climate-aware.

9. Is Sindhudurg land investment suitable for NRIs in 2025?

Yes, Sindhudurg is increasingly attracting NRI interest due to its coastal lifestyle appeal, lower density, and long-term growth outlook. NRIs researching Sindhudurg land investment 2025 often view it as a diversification asset rather than a speculative trade. However, NRIs must comply with FEMA guidelines and ensure that all land purchases comply with Indian property regulations.

10. Who should avoid investing in Sindhudurg land in 2025?

Sindhudurg land investment is not ideal for everyone. Investors seeking quick returns, immediate rental income, or low-involvement purchases may find land unsuitable. Sindhudurg land investment 2025 is better suited to patient investors willing to understand infrastructure timelines, regulatory frameworks, and long-term value creation. Land rewards preparation and patience more than urgency.

Why Sindhudurg Is Being Studied — Not Sold

One of the most telling signals in real estate is how a location enters public conversation. Some places are marketed aggressively long before they are ready. Others surface slowly, through research papers, policy discussions, and quiet investor analysis. Sindhudurg belongs firmly to the second category.

The growing interest in the Sindhudurg land investment 2025 is not the result of loud promotion or mass advertising. It is emerging from a different place altogether: data, infrastructure alignment, and long-term livability analysis. This distinction matters because markets that are “sold” early often peak early, while markets that are “studied” tend to mature more sustainably.

A Market That Rewards Research, Not Impulse

When a location is heavily marketed, most narratives sound the same: high returns, fast growth, limited availability. Sindhudurg’s narrative is different. The questions people are asking online are not impulsive; they are analytical:

- How will expressway connectivity reshape access over the next decade?

- What happens to coastal land values when supply is regulated but demand rises?

- Is this region structurally prepared for growth, or just temporarily trending?

These are not the questions of short-term speculators. They are the questions of people allocating capital with intent. That is why Sindhudurg land investment 2025 appears more often in research-driven searches than in promotional content.

Infrastructure Before Hype — A Rare Sequence

In many Indian real estate stories, hype arrives before infrastructure. Prices rise on promise, not progress. Sindhudurg is unfolding in reverse. Major infrastructure decisions — particularly the Nagpur–Goa Shaktipeeth Expressway — were approved and funded before mainstream attention followed.

This sequence changes everything.

When infrastructure leads, and marketing follows (or doesn’t follow at all), price discovery remains grounded. Investors studying Sindhudurg land investment 2025 are effectively observing a region where connectivity is being built first, and speculation has not yet overwhelmed fundamentals. Historically, such phases offer the most balanced risk-to-reward profiles.

Regulatory Friction as a Filter, Not a Barrier

Another reason Sindhudurg is being studied rather than sold is the regulation. Coastal Regulation Zone (CRZ) rules, land classification requirements, and environmental safeguards introduce friction into the buying process. While this deters casual buyers, it attracts serious ones.

Markets with zero friction often attract the wrong kind of attention — quick money, poor planning, and oversupply. Sindhudurg’s regulatory environment acts as a filter, ensuring that only informed, patient capital enters. This is precisely why analysts and long-term investors are taking time to understand Sindhudurg land investment 2025 rather than rushing into it.

A Shift From “Returns” to “Resilience”

Another subtle but important change in investor mindset is visible here. Earlier real estate cycles were driven almost entirely by price appreciation. Today, investors are equally concerned with resilience — environmental, regulatory, and social.

Sindhudurg’s appeal lies in its ability to support:

- Low-density development

- Climate-responsive planning

- Long-term habitability rather than short-term monetization

This is why discussions around Sindhudurg land investment 2025 increasingly reference sustainability, water security, and ecological balance. These are not marketing terms; they are risk indicators. Locations that can adapt to future regulations and climate realities tend to preserve value better over time.

Studied Markets Create Informed Buyers

When a market is sold aggressively, buyers often rely on promises. When a market is studied, buyers rely on understanding. Sindhudurg currently belongs to the latter phase.

People researching Sindhudurg land investment 2025 are:

- Reading government notifications

- Tracking infrastructure timelines

- Comparing micro-locations

- Understanding zoning and access

- Evaluating long-term lifestyle feasibility

This depth of inquiry suggests that Sindhudurg is attracting decision-makers, not impulse buyers. That alone is a strong indicator of healthier long-term price behavior.

The Quiet Phase Before Visibility

Every major real estate destination passes through a quiet phase — a period when information spreads faster than popularity. Sindhudurg appears to be in that phase now. It is visible enough to be researched, but not visible enough to be crowded.

This is why it is being studied — not sold.

For those willing to invest time before investing capital, Sindhudurg land investment 2025 represents an opportunity defined not by noise but by knowledge. And in real estate, knowledge tends to compound just as powerfully as capital.

Latest Posts

Nine Divine Group specializes in sustainable living, eco-friendly development, and heritage property restoration for modern lifestyles.

TOP NEWS

CONTACT INFO

Phone:

+91 72 9100 8100

Email :

info@ninedivinegroup.com

Address :

FF-12A, Sethi mart, near Mahagun Meadows,

Sector 150, Noida, Uttar Pradesh 201304

© 2025 Nine Divine Group. All Right Reserved.

No Comments